PROJECT FINANCE MEDIATION

In today’s fast-paced financial world, securing funding for your projects can be a daunting task. We understand the challenges that business owners face when trying to obtain financing. That’s why we specialize in project finance mediation, acting as the crucial link between project owners and genuine funders.

We mediate credible financing to bankable projects after subjecting the projects to our 3-WAY TEST LEVEL:

- PROJECT PROFITABILITY

- PROJECT CREDIBILITY

- INFRASTRUCTURAL RELEVANCE

Our Project Finance Mediation service includes a premium offering called Project Documentation Alignment (PDA). PDA is a specialized service that focuses on ensuring the alignment of project documentation with the requirements of the funder. Our team of experts works closely with clients to review and enhance their project documentation, ensuring that it meets the necessary standards and addresses all key aspects required by the funder. By utilizing PDA, we aim to add significant value to the client’s documentation process, increasing the likelihood of securing funding for their project.

PROJECT DOCUMENTATION ALIGNMENT (PDA)

Project Documentation Alignment (PDA) is a service offered by our company to assist clients in preparing their documentation process to meet the requirements of funders. We understand that securing funding for projects is crucial for the success and growth of businesses, and having well-aligned project documentation is essential in this process.

Our team of experts specializes in analyzing the specific requirements set by funders and aligning our clients' project documentation accordingly. We work closely with our clients to understand their project goals, objectives, and funding needs. By doing so, we can tailor the documentation process to meet the unique requirements of each funder.

Our service includes a comprehensive review of the existing project documentation, such as proposals, business plans, financial statements, and impact assessments. We ensure that all necessary information is included and presented in a clear, concise, and compelling manner.

Additionally, we provide guidance and support in identifying any gaps or areas that need improvement in the documentation. Our team offers valuable insights and recommendations to enhance the overall quality and effectiveness of the documentation, increasing the chances of meeting funder requirements.

Throughout the process, we maintain open communication with our clients, providing regular updates and seeking their input and feedback. We understand the importance of collaboration and strive to create a seamless partnership to achieve the desired outcomes.

By utilizing our Project Documentation Alignment service, clients can save time and effort in navigating the complex landscape of funder requirements. Our expertise in aligning project documentation with these requirements increases the likelihood of securing funding and enables clients to focus on their core business operations.

In summary, our company's service offering of Project Documentation Alignment aims to prepare clients' documentation processes to meet funder's requirements. We provide comprehensive analysis, guidance, and support to ensure that the project documentation is well-aligned, compelling, and meets the expectations of funders.

BUSINESS PROFITABILITY CONSULTING (BPC)

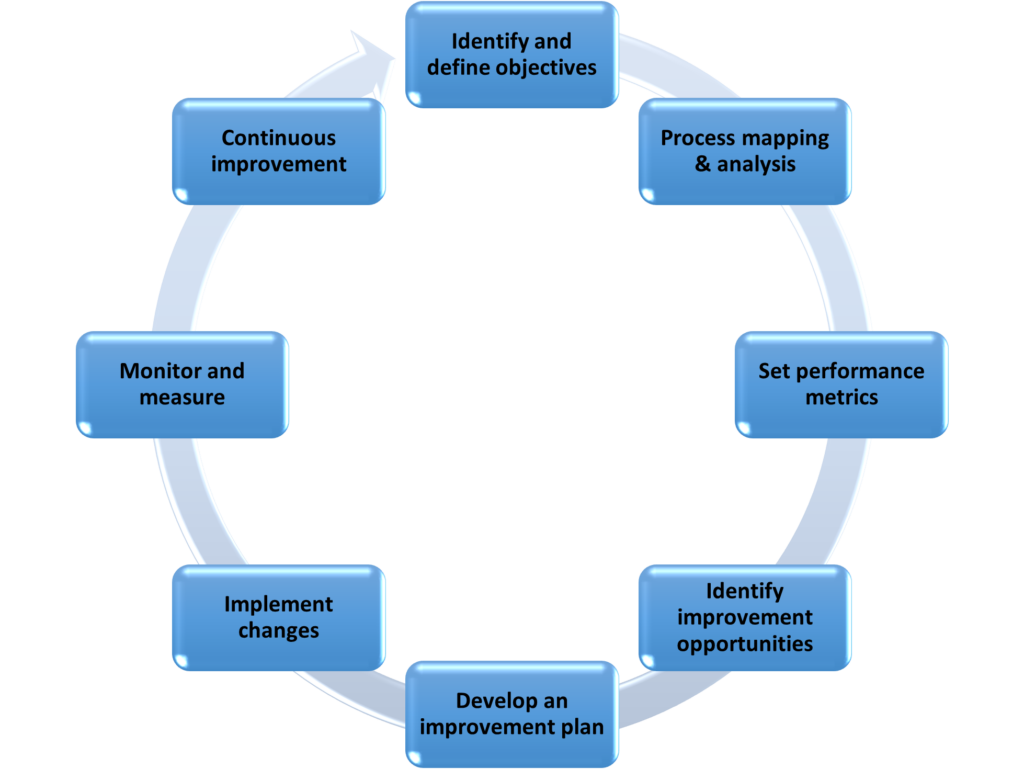

Every business has its unique processes and workflows that have evolved over time. The goal of our Business Profitability Consulting (BPC) service is not to completely discard your existing processes but rather to enhance them in order to achieve better operational performance and improved profitability.

By analyzing and optimizing your existing processes, we can help you identify areas where inefficiencies exist, bottlenecks occur, or where manual tasks can be automated. This allows for streamlining operations, reducing costs, and improving overall productivity.

Our BPC service also help your business adapt to changing market conditions, customer demands, and technological advancements. It helps organizations stay competitive by continuously evaluating and enhancing their processes to meet evolving business needs.

It is important to note that business process improvement is not a one-time effort but an ongoing practice. As your business grow and evolve, your processes need to be regularly reviewed, refined, and optimized to ensure they remain aligned with your organizational goals and objectives.

ESG Integration and Corporate Governance (ECG)

Environmental, Social and Governance (ESG) issues are of increasing concern to the investor community. Companies are also facing rising expectations from different stakeholders to take a proactive approach to manage ESG risks and opportunities as part of their business strategies. Investors are now demanding corporate leaders improve sustainability practices that both benefit their firms’ bottom line and create greater impact on the wider community. Our ESG integration services help companies identify and address ESG risks and opportunities, improve transparency and accountability, and enhance their overall performance and reputation.

Most of the businesses across the continent especially those who are in need of foreign direct investment have increasing need to put structures, processes and systems in place to attract investors and remain competitive.

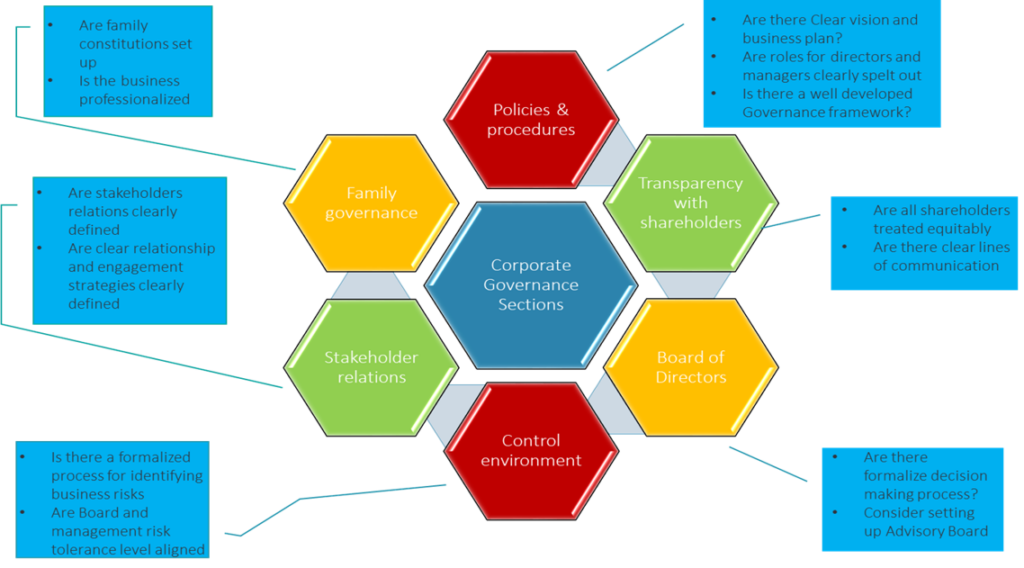

Our corporate governance review service is in line with the Dubai SME Code of corporate governance. We have developed a holistic work approach and methodology which seeks to ask strategic questions that are important for determining your current level of compliance across the different Corporate Governance sections, identify the gaps and how we can provide needed support.

ACCOUNTING & SOFTWARE IMPLEMENTATION (ASI)

Accounting Advisory

As your business goes through change and your industry evolves, there is an ongoing need to ensure that your accounting treatment is correct, and your financial statement are compliant.

There are many triggers that can impact your financial statement and accounting processes such as:

- • New accounting standards affecting your balance sheets, reported results, and accounting policies and manuals

- • Changes in the reporting framework which must be reflected in your financial statement and the wider business

- • Business events such as entering new contracts, acquiring or disposing of a subsidiary, and group restructuring

- • Updated disclosure requirements impacting the compliance of your financial statements

- • Digital developments in accounting and reporting, creating opportunities for accounting and reporting efficiencies

We are experienced in advising clients on the challenging and complex issues arising from transactions and business decisions.

We partner with renowned technology companies to provide our clients with the best-fit accounting and HR system that can be integrated into their business operations and workflow.

We design/re-design your accounting process and functions for easy flow of accounting and finance processes, accurate and timely reporting and improved automation of financial data.

MANAGEMENT

CONSULTANCY SERVICES

We bring to bear specialized knowledge skill and experience in areas including business start up advisory and process review, corporate facility management and ancillary services, project performance evaluation and advisory , project team capacity development and knowledge transfer.

We provide high quality value added professional statutory audit & assurance services to clients across various industries.

Our audit involves an in-depth understanding of our client’s business internal controls, and risk spectrum in order to develop an approach that is tailored to the client’s needs. Before making audit planning decisions and to help in assessing risk, we conduct diagnostics and an analytical review.

The composition of our team, backed up with extensive experience, puts us in an advantageous position to maximize futuristic development opportunities through efficient and up-to-date standard of professional services structured around a multi-disciplinary framework.

APEX

Audit Methodology

Our audit methodology is to carry out a risk based audit approach system, which apart from satisfying the primary objective of reporting on business and financial statements, it also aim at identifying problems associated with record keeping to which we offer appropriate solutions.